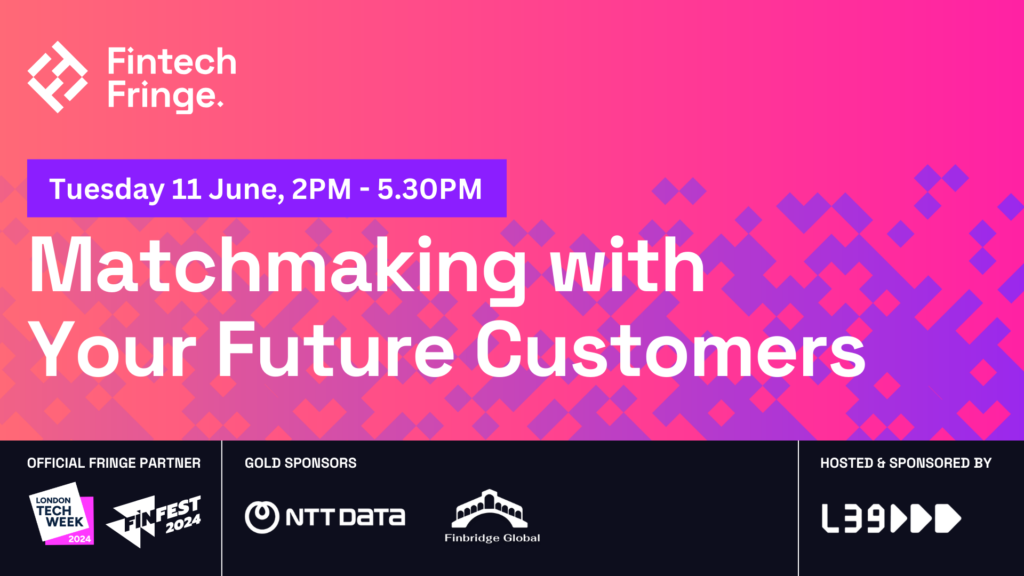

fINTECH FRINGE FESTIVAL 2024

june 11: customer matchmaking

JOIN our Matchmaking Session POWERED BY FINBRIDGE GLOBAL

Look forward to an afternoon of meeting with pre-qualified customers that match your fintech’s capabilities.

With a industry standard assessment of your fintech, we will connect you with the right financial institutions to provide insight, advice and hopefully commercial opportunity.

DEADLINE 30TH MAY

EVENT Keynote: Barbara Gottardi, Co-Founder and CEO Finbridge Global

Barbara Gottardi is the CEO and founder of Finbridge Global. A global platform assessing and comparing fintechs to reduce the RFI time in the financial industry. She also serves as CEO of Wedlvr Ltd, specializing in aiding companies through digital transformations ands she is a Ned at Cashplus Bank. Previous role includes interim CIO for Admiral Money, senior advisor at Alvarez & Marsal focusing on digital transformation and CIO roles. With 16 years at HSBC and as Vanguard Europe’s CIO, she implemented innovative digital strategies. Barbara has 2 teenager boys and she is a keen runner.

get your fintech fit-checked

Would you like to have an understanding of your company’s readiness and understand what your fintech needs to improve to partner with Financial institutions and large enterprise customers?

Finbridge Global assessment engine provides a reliable, consistent and objective way to measure a fintech’s capabilities and competencies.

It streamlines the value judgement process, reduces manual effort and human error and provides real-time feedback, analysis and insights to help your fintech identify strengths and weaknesses and areas for improvement.

We use this to help us assess your readiness to meet with customers and also to connect you with expertise to improve your score.

APPLY BEFORE 27 MAY

It takes time to matchmake so there is a deadline if you want to take part. Make sure you purchase your ticket and complete your assessment before 27 May.

We recommend 1 person/ company.

Assessment

Once you have purchased your ticket you will be sent a link to complete your assessment.

The assessment consists of a set of questions and only takes 15-20 minutes to complete. You will then receive a score and a detailed view across the key capabilities.

what to expect ON THE DAY

You’ll be provided a list of up to 5 meetings ahead of the event so you’ll know who you are meeting and will have time to prepare.

It will be an open-plan meeting room setup with lots of meetings taking place around you. Each meeting is scheduled to last for 25 mins with a 10 minute break between appointments.

You’ll need to bring your own laptop (fully charged) if you need to demo anything.

There will be staff on-hand to help if you need support and refreshments will be available.

pROUD TO PARTNER WITH Finbridge Global

Through our partnership with Finbridge Global, we are able to offer fintechs the chance to assess their enterprise readiness against key criteria determined by financial institutions.

Finbridge Global is a platform that assesses and scores fintech capabilities through an industry standard Assessment Engine.

They provide fintechs an understanding of where they are and where they need to improve to partner with Financial institutions.

Their proprietary assessment engine examines the capabilities of a fintech product, then identifies and connects founders to organisations with a requirement.

It enables institutions to shorten the time to search, compare and select the right partner to work with, knowing it is a match for their architecture.

Technology providers are empowered to demonstrate their differentiation, intermediaries have a single platform to source and investors can quickly identify and nurture growth opportunities.

All benefit from reduced time to market and a reduced cost of due diligence.