At Fintech Fringe, our mission is to help fintechs scale and grow. Scaling successfully is no small feat—it requires navigating complex challenges in fundraising, regulation, talent acquisition, legal frameworks, and PR.

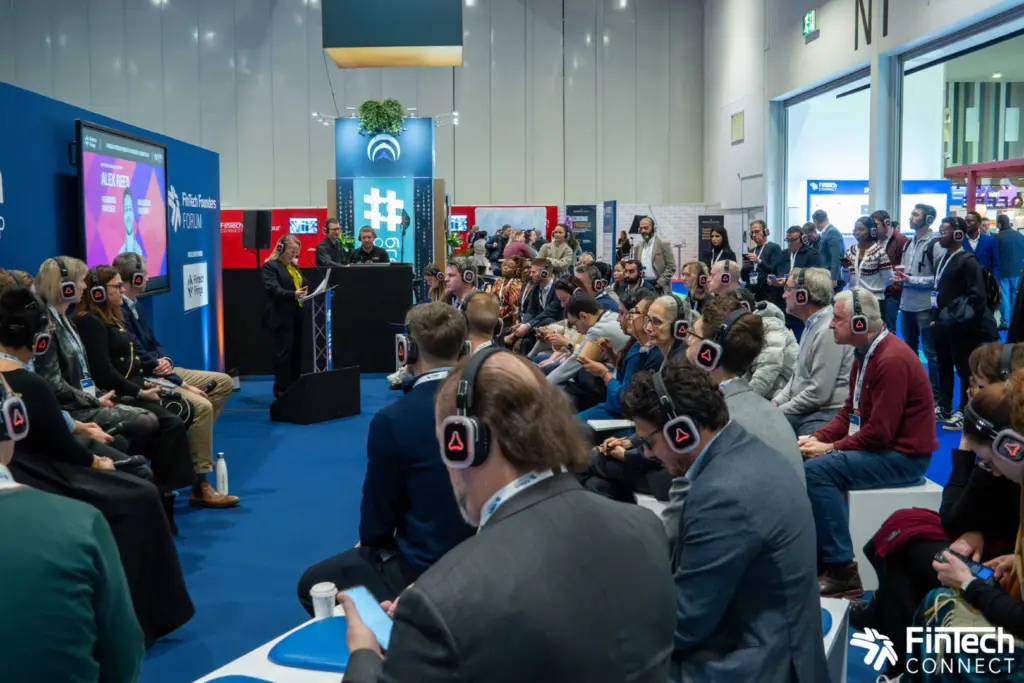

Last week, we hosted our first-ever satellite event at Fintech Connect, where I had the privilege of moderating a session for the very first time. The discussion brought together leading experts to share actionable advice on tackling these challenges.

Here’s the key takeaways from the panel discussion, offering practical guidance for fintech founders scaling their businesses.

Regulatory Compliance vs. Legal Strategy: Distinctions and Collaboration

Navigating regulation and legal complexities are critical for fintechs, and this session underscored the distinct but complementary roles of compliance specialists and legal advisers. Chris Hill, fintech lawyer and partner at Fox Williams LLP, and Alison Donnelly, payment regulation specialist at FSCOM, both provided invaluable perspectives.

Chris opened by addressing the inherent risks of operating in a highly regulated and rapidly evolving sector:

Innovators often push boundaries, but the consequences of missteps can be severe—from enforcement actions to undermining investor confidence.

"In regulatory terms, you’re only ever one bright idea away from a breach," he explained, highlighting the importance of understanding the regulatory perimeter.

Chris Hill, Partner, Fox Williams

Innovators often push boundaries, but the consequences of missteps can be severe—from enforcement actions to undermining investor confidence.

Chris emphasized the importance of reassessing compliance regularly, particularly when changing business models:

Innovators often push boundaries, but the consequences of missteps can be severe—from enforcement actions to undermining investor confidence. Chris emphasised the importance of reassessing compliance regularly, particularly when changing business models:

"Look early and look often. Be clear about what your business can and cannot do within its permissions, and check frequently if you're operating at the edge."

Chris Hill, Partner, Fox Williams

Alison, on the other hand, focused on embedding a compliance culture within fintechs, starting from day one. As the former e-money policy specialist at the FCA, Alison has seen firsthand the long-term impacts of non-compliance:

"Fines are just the tip of the iceberg. Non-compliance erodes trust and can permanently damage careers. Embedding compliance into your company’s DNA is non-negotiable."

Alison Donnelly, Director, fscom

While Chris often supports fintechs on contracts, intellectual property, and broader risk assessments, Alison’s expertise lies in operational compliance—ensuring businesses meet regulatory expectations daily. The two roles, as Chris pointed out, work hand-in-hand:

"A robust compliance framework is the foundation on which legal strategies can build."

Chris Hill, Partner, Fox Williams

One key piece of advice from Alison was to consider working with authorised partners in the early stages to reduce regulatory burden. She explained how such partnerships can provide a pathway to scaling without overextending resources.

Fundraising: From Metrics to Methods

Fundraising is at the heart of scaling, and Alex Reed, co-founder of Mountside Ventures, shed light on how the landscape is shifting.

"The days of growth at all costs are over. Investors now prioritise efficient growth, focusing on metrics like net revenue retention (NRR) and the Rule of 40," he explained.

Alex Reed, Co-founding Partner, Mountside Ventures

Key Fundraising Metrics:

Net Revenue Retention (NRR): Measures customer stickiness and upselling potential. High NRR signals strong customer value.

Rule of 40: Balances growth rates with profitability. For example, a company growing 50% annually with a -10% profit margin achieves a Rule of 40 score of 40, an ideal benchmark.

Alex provided a practical roadmap for fundraising:

Preparation: Build a robust financial model, prepare a comprehensive data room, and anticipate investor questions.

Outreach: Seek warm introductions rather than relying on cold emails, which have a near-zero success rate.

Negotiation: Keep multiple investors aligned to secure the best terms.

He shared the success story of ApprovalMax, a fintech that secured multiple term sheets through a professional and structured fundraising process. The valuations varied widely, illustrating the importance of preparation and leveraging competitive offers.

Building Teams for Long-Term Growth

Nadia Edwards-Dashti, co-founder of Harrington Star Group, brought a people-first perspective, highlighting the critical role of talent in scaling.

"No business can scale without the right team. Yet, fintechs often hire reactively, focusing on short-term needs rather than long-term alignment with their mission and values," she said.

Nadia Edwards-Dashti, Co-founder of Harrington Star Group

Nadia’s insights were a wake-up call for founders, particularly regarding retention. She revealed that the average tenure for developers in fintechs has dropped to just 13 months. This high turnover rate disrupts projects and increases costs.

Her advice? Hire forward, not backward:

"Think about where your business is headed and hire people who align with your mission and values. Investing in your team’s growth and creating a safe, supportive environment is crucial to reducing unwanted churn."

Nadia Edwards-Dashti, Co-founder of Harrington Star Group

Nadia also stressed the importance of understanding employee motivations and fostering an open dialogue to address their needs.

PR: Your Secret Weapon for Scaling

PR can be a game-changer for scaling fintechs, as explained by Angela Yore, CEO of SkyParlour.

"Your culture is your magnet. Get it right, and the right talent, customers, and investors will follow," Angela said.

Angela Yore, CEO, SkyParlour

She encouraged founders to step up as the public faces of their businesses:

"Don’t shy away from PR. Founders are often their companies’ biggest assets. Use your platform to share your vision, address customer pain points, and position yourself as a thought leader."

Angela Yore, CEO, SkyParlour

Angela shared examples of fintech leaders who leveraged PR to secure funding and grow their businesses, demonstrating the tangible benefits of aligning brand storytelling with business goals.

Strategic Insights for Scaling Fintechs

In a lightning round, the panellists shared their top tips for scaling:

"Be pragmatic about risk. Reassess your assumptions regularly, especially as your business grows."

Chris Hill,Partner, Fox Williams

"Transparency is key. Keep regulators informed of changes—it’s non-negotiable."

Alison Donnelly, Director, fscom

"Efficient fundraising starts with preparation. Know your metrics and engage with the right investors."

Alex Reed, Co-founding Partner, Mountside Ventures

"Invest in your people. If you think talent is expensive, consider the cost of losing it."

Nadia Edwards-Dashti, Co-founder, Harrington Starr

"Your company’s culture is its foundation. Build it strong, and the right opportunities will follow."

Angela Yore, CEO, SkyParlour

Conclusion: Scaling with Confidence

Scaling a fintech requires a multi-faceted approach. From regulatory compliance and efficient fundraising to building strong teams and leveraging PR, each piece of the puzzle plays a critical role.

At Fintech Fringe, we’re committed to helping fintechs navigate these challenges with confidence.

What’s your biggest challenge when it comes to scaling?

We’d love to hear your thoughts—let’s keep the conversation going.

– ENDS –